Writing for Animals!

Writing for Animals — It’s a course!! It’s a book!! It’s — it’s — it’s what I want to do!!!

If you read my last post, you know that something I have been thinking about doing, off and on, for a while now, has been to go on the road and write about animals. Visit a lot of animal sanctuaries and rehab facilities and then write about my experiences there. In the process, the goal is to educate myself and others to the myriad of species out there — both wildlife and domestic. Visit state and national parks along the way and see how climate change is affecting them both in terms of their wildlife and plants/trees. Again, write about them and educate myself and others in the process. Who knows? Maybe it could eventually become a book someday.

So when Ashland Creek Press, whose email list I subscribe to, informed me that they were going to be offering a four-week writing course in January entitled Writing for Animals, using a book by the same name as one of its texts, I jumped at the chance! I’ve already received the book and started reading through it and am excited for the course. The course is already full, but because there was such a good response to the inaugural session, they will be holding at least one more. You can sign up for their mailing list here and learn about the course’s leaders here (Midge Raymond and John Yunker).

Reading through the text, I am reminded of some of the lessons from the courses I took through the Institute for Humane Education, or IHE as it’s known. Always be very aware of your audience and be extremely aware of the language and terminology you use. For example, what’s the difference in referring to an animal as he, she, or it? It makes a difference and can sometimes show some insight into the upbringing or experiences of the writer. for example, using the term “it” can demonstrate speciesism, intentional or not. Even my choice of image below conveys certain ideas about how I view animals and desire others to view them. I can’t wait for this course!

RV Surprise!

My brother and sister-in-law have been traveling through Latin America and South America for a couple years now, in a truck and camper. You can read more about their adventures at It’s Not a Slow Car, It’s a Fast House. (I highly suggest you do, as Geneva is a really good writer and you can learn a lot about so many different topics from reading her posts.) Before the truck camper, they traveled throughout the US and Canada with a Vanagon named Alta. They know I tried out RV living a few years ago when I was in Utah, working for Best Friends Animal Society, when I had a 30 foot fifth wheel set up in a mobile home/trailer park. That wasn’t the right fit for me for many reasons: remote location, stationary location for the RV (and my inability to tow it on my own).

My brother sent me a link to a Cruise America video and said “this would be the perfect size for you.” It’s a Class C motor home, 19 feet in length. (If you don’t know what the different classes of motorhomes are, think of the ones that have a bunk over the cab. Not a van-type body (those are Class Bs) or as long as a bus (those are Class As). Now, I am familiar with Cruise Americas from my time working in Page, Arizona at the Wahweap RV and Campground at the Lake Powell Resorts and Marinas. And if you click on that link and are wondering, does it really look like that? Um, YES!! It really is a gorgeous area located near the Navajo Nation’s Reservation. But I’ve never driven a motorhome myself, even though I’ve been in many a travel trailer and motorhome during my life.

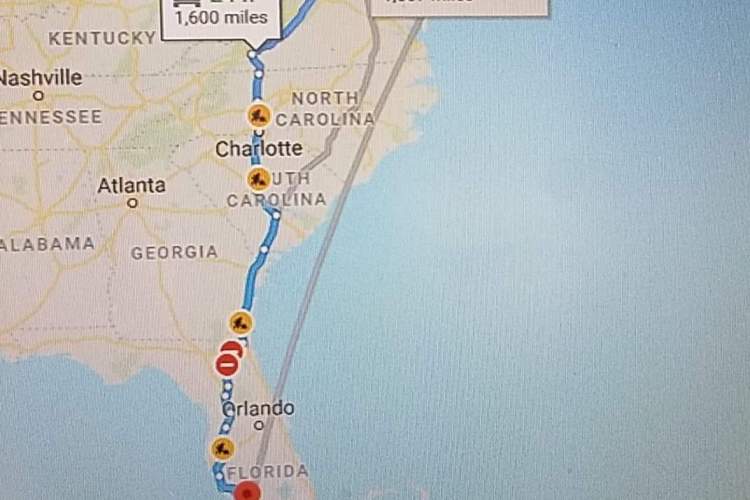

So, I decided I would start saving to rent one in the spring and take my animals along for the ride; see how my fur family and I handle being together in such a space as i am considering buying one when my lease is up in July. Geneva and Mike mentioned to me that they have a friend who rented one of theirs once as part of a transport for the company, and got a good deal on the price of the rental and many free miles. You can learn more about that by clicking here. So that’s what I am doing! I am flying to Boston on Christmas Day. My flight was $37!! On Jet Blue!! How insane is that?? And then I will drive it back to Florida!

I am taking Snuggles with me for a few reasons. First, Jet Blue limits you to flying with a pet and carrier that combined are only 20 pounds. My Sophie girl alone is 23 pounds, so I can’t take her, plus she might be a bit too long or tall for flying under the seat. Second, Snuggles and Sophie are both my early warning systems when there is danger (or what they perceive to be danger or just a human being, or animal) nearby. And third, I know he gets very depressed when I am not around. When I went to my nephew’s wedding in Arizona in March 2019, my friend Sarita said he moped the entire time I was gone and didn’t want to come out the bedroom. Sophie is a bit more independent and happy go lucky, so while she will miss me and I will really miss her, I know she can handle the separation better than he can.

Upon arriving back in Florida, I will be hooking up to the electric (and water if there is an outside connection) to the guest house where my brother is staying (I got permission from him and his in-laws whose guest house he is staying in) for a few days. That will be my opportunity to get Sophie and the cats and see how they all do in such a space, or to find out if the next size up might be a bit better. There are Class Cs that are 22, 23, and 24 feet as well as much longer, and Cruise America has a 23 footer. It’s my thinking a Class C might be good because the cabover bed may be a great way for the cats to have their safe sanctuary away from the dogs when needed. So you could say this is my TEST run! Maybe it will be too small. Maybe it will be too big. But maybe, it may be just right. 🙂

Cruise America and Cruise Canada do sell their units, refurbished, after they are about 3 to 4 years old. The mileage is on the higher side but on the other hand, you will know the maintenance history and they are also upgraded in ways to withstand the wear and tear of rental use. For my trip, it will cost me $39 per night and I get 2500 free miles, more than enough to make the trip from Boston to the Orlando area. (Actually down to Naples and then back up to turn in the RV.)

This will be the first time I make this drive between Mass and Florida without it being in my small Mazda2 crammed in with all The Herd and my stuff! Whatever will I do with all this space???

But aren’t you worried about Covid?

So you may be aware that I have already had Covid. While it is extremely rare, I know you can get it more than once. So I am being very careful on my end, as my friend in MA with whom I will be staying for a couple days is pregnant and in her second trimester. I will be getting a Covid test within 72 hours of my flight.

People see the news and think that everyone in Florida is partying on the beach without a care in the world and basically inviting Covid into their life. Don’t believe everything you see. Stores pretty much require masks. Restaurants require them until you are seated at your table, and restaurants practice social distancing with less than full capacity — I think they are allowed 50 percent capacity at most. Last couple of months, I have been running outside or going to the beach to walk or run, for my exercise. Wear a mask when in public around others. Honestly, I’m home a lot. And a great number of people down here take social distancing and the advice of wearing masks to heart. We are just lucky in that we have good weather all year round so we can be outside and social distance more easily than in cold climates. Rest assured, the idea of going through that experience of Covid again is not at all appealing to me. I will be careful both before, during and after my trip.

So anyway, that’s my news!! The trip begins December 28th! For safety reasons, I won’t be posting real-time photos, but will let some folks know my itinerary once I figure it out and where I am.

For now, I am off to research cat harnesses and to attempt to find a second hand winter coat for my trip. Wish me luck — the odds of finding one in southwest Florida are somewhere between slim and none!

Thanks for reading!